Thanks to the partnership agreement with “Partnerstwo” Foundation, for the 3rd consecutive year we can turn to you with a request to donate 1% of your 2016 tax settlement to Rugby Wrocław.

Every taxpayer can take this opportunity in two ways:

- fill the tax statement and calculate the amount equal to 1% of the income tax and then donate the calculated amount to the selected public benefit organization.

- pay any amount of money (unlimited) to the public benefit organization; but when filling out the annual statement, the tax can be reduced only for 1%;

Please remember to submit the statement in the revenue office by April 30

Thanks to help of the donnors, we managed to acquire so far 3,000 zł which have been totaly spent on children and youth Rugby TAG tournaments. What is more, we could also fund trip of our U-16 team to Polish Championship Rugby 7s Semi-finals. Thank you!

The money which fund our budget let us getting kids into rugby in Wroclaw and Lower Silesia region.

Rugby Wrocław Sport Club is totally funded by members’ fees, donations and from public contests, therefore every zloty spent on the Club is very valuable for us.

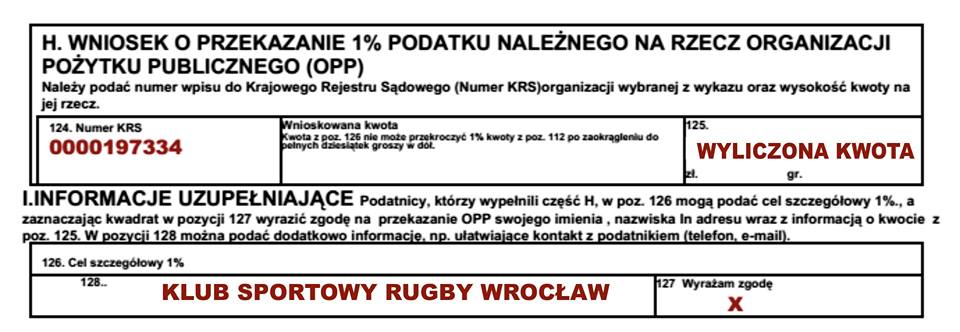

How to reduce your tax at 1%?

STEP 1

From the amount of due tax deduct the amount of 1%. Remember that you can donate an unlimited amount but you can reduce your income tax only for the amount equal to 1% of the due tax.

Please remember to include:

- KRS number: 0000197334

- Name of the donatory: Klub Sportowy Rugby Wrocław

STEP 2

SUBMIT YOUR TAX STATEMENT

Submit the statement in the revenue office by April 30 (in 2006 till May, 2).

Keep the proof of the payment to be shown in case of the controlling procedure if the tax office.

STEP 3

RESULT

In case of overdue payment the revenue office will return the amount equal to 1% of the tax. In other situations the due tax shall be reduced for the amount donated to the public benefit organization equal to 1% of the due tax.

In case that you have any questions, please contact the tax office.

* According the regulation issued by the Polish Post Office bank fees on 1% payments to the public benefit organizations have been reduced from 2,5 PLN to 1,00 PLN.

How to donate any amount?

STEP 1

Check the NGO’s data necessary to make a payment:

- full name: Klub Sportowy Rugby Wrocław

- address: ul.Piękna 64f/25, 50-505 Wrocław

- and bank account number: 12 1090 2473 0000 0001 1589 0898

STEP 2

FILL IN THE PIT FORM AND CALCULATE 1% OF YOUR TAX

Fill in the appropriate PIT form (PIT-36 or PIT-37) and calculate the amount of the tax*. Calculate 1% of the due tax and put this amount in the proper table.

- Position no 179 in the PIT-36 form

- Position no 111 in the PIT-37 form

*Taxpayers conducting business activity pay the flat-rate tax, and use the PIT-28 form (position no 103). In that case tax statements are submitted till the end of January of the year subsequent to the given fiscal year. Attn: Do not submit the statement prior to making the payment!

STEP 3

FILL IN THE TRANSFER FORM

The form must include:

- Name and surname of the donor

- Address of the donor

- Amount to be transferred

- Name of the selected organization: Klub Sportowy Rugby Wrocław

- Purpose of the payment, e.g. “donation 1% for the public benefit organization”.

STEP 4

MAKE A PAYMENT

Transfer the calculated amount to the bank account of the selected organization. Do it between May 1 and December 31 of the fiscal year, and from January, 1, till April, 30, of the subsequent year – the day when you submit your tax statement.

You can do it:

- in the bank (also via internet)

- or in the post office